Republican primary candidates discuss property tax relief, other priorities

Property and business taxes were focal points for all six Republican candidates at the Hutchinson/Reno County Chamber of Commerce’s Reno County Legislative Forum Thursday evening.

Debra Teufel, who acted as moderator and serves as the chamber’s president and CEO, asked the candidates in the three contested primaries in Reno County questions submitted prior to the event.

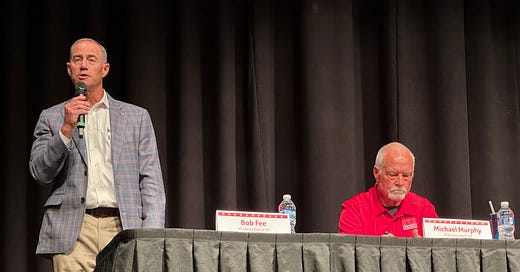

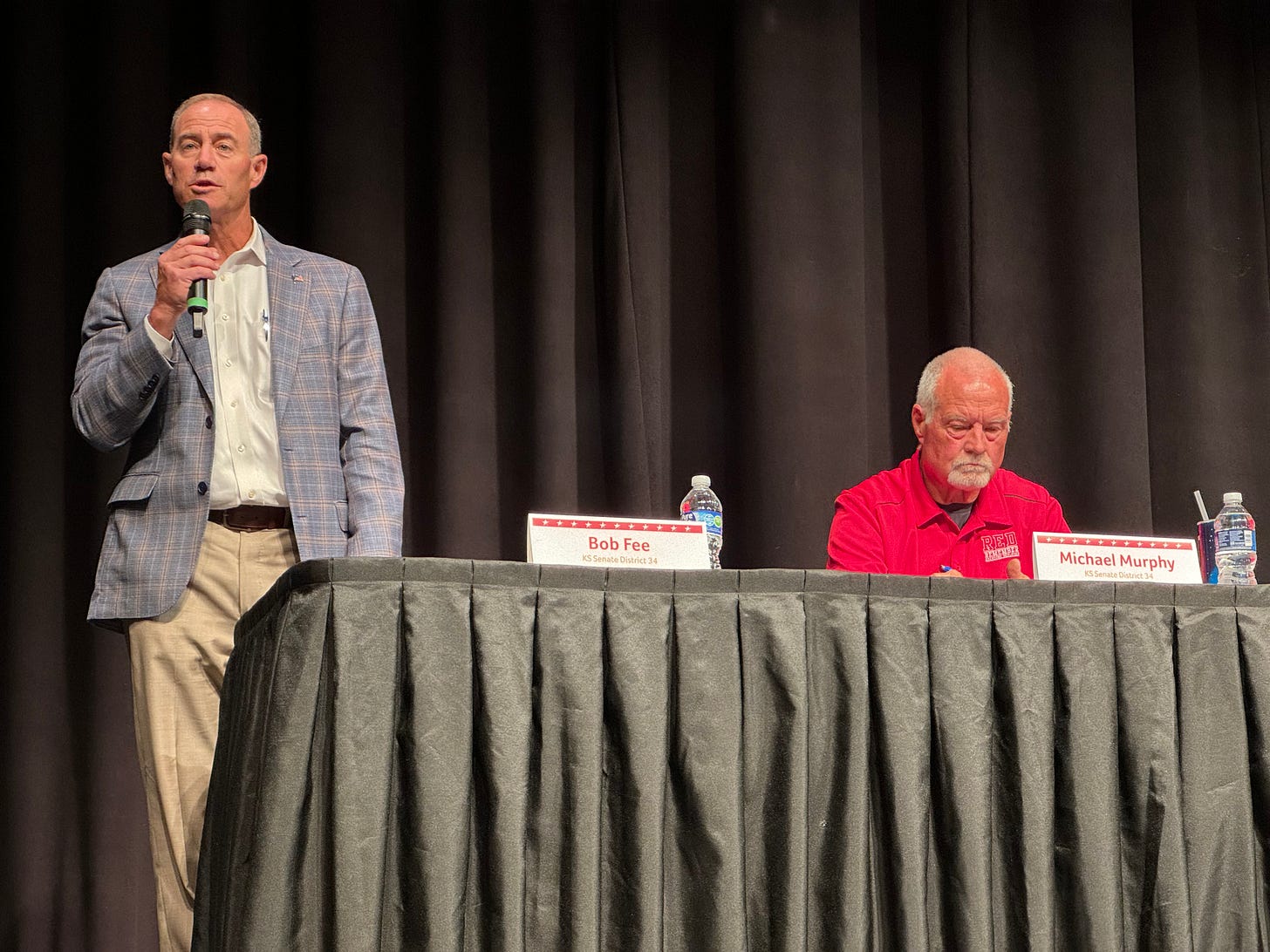

Kansas Senate District 34

Candidate Bob Fee, who is running for Kansas Senate District 34, said a main concern he has heard while campaigning is property taxes.

“Property taxes in Kansas have skyrocketed over the last 10 years for multiple reasons,” Fee said. “The state of Kansas just passed a tax reduction but not very much of it was property taxes.”

The State of Kansas controls only a portion of property taxes, with local governments such as county, city and school boards making up the rest of the total.

Kansas levies 20 mills on every property in the state, with the revenue going to fund education.

“We do have a spending problem,” Fee said. “That is the biggest problem we are facing right now. Our budget has gone up 35% in spending, and we are sitting in almost $3 billion in reserves. It is a problem for folks, and we did not address the property tax issue at the state. Knock down the mills at the state level.”

Michael Murphy, Fee’s challenger and the current representative for the Kansas House 114th district, said property tax is also a concern for him. Murphy said he attempted to help Kansans with property tax relief but the bills which provided relief were vetoed by Governor Laura Kelly.

“I brought an amendment to the budget for property taxes which got vetoed,” Murphy said. “I have a record of having that in mind and making it a priority.”

Kansas House District 102

Candidate Tyson Thrall said he believes higher tax burdens are part of the reason why young families are not moving to the Sunflower State.

Referring to tax legislation that was passed in the 2024 Kansas Special Legislative Session, Thrall said he didn’t think the legislation went far enough.

“I think Kansas, people are not seeking to move here due to tax burdens,” Thrall said.

Opponent Kyler Sweely said reducing property taxes is an important issue to him.

“We have to stop pricing people out of their homes,” Sweely said. “Both chambers passed seven tax breaks, and the governor vetoed it all. We didn’t do anything for social security tax or property tax. We have Kansans leaving here at a huge rate, and we’re failing Kansas right now.”

Kansas House District 114

Steve Schweizer, a candidate for Kansas House District 114 which encompasses much of rural Reno County, said business taxes were of major concern to him. He added water rights were also important to his campaign.

“To attract workers to our state, we need more competition, and businesses in general need to have a fairer tax plan,” Schweizer said. “We’re having to battle for water rights and managing the water. We need to stand up for Kansans and protect them from the federal government.”

Schweizer’s opponent, Candidate Kevin Schwertfeger, said property taxes have caused many seniors to struggle to live in their own houses. Schwertfeger said the state should look at lowering or even eliminating property taxes if possible.